Here is an article about the role of governance tokens in Enhancing Market sentiment around cardano (ADA):

The Power of Governance tokens: How Ada’s Governance Model Drives Market Sentiment

In the world of cryptocurrency, the traditional concept of “market sentiment” refers to How Investors and Traders Perceive the Overall Outlook for a particular asset. It can be influenced by varous factors such as news, speculation, social media buzz, and institutional adoption. In recent Times, The Role of Governance tokens in Enhancing Market sentiment around Cardano (ADA) Has Gained significant Attention.

What are governance tokens?

Governance tokens, also Known As Utility Tokens or Utility-Backed tokens, are Issued by Blockchain Projects to Incentivize Participation from Contributors, Developers, and Stakeholders. They represent a claim on a portion of the projects assets or revenue. In The Case of Cardano (Ada), The Governance Token is Ada Itelf.

The role of governance tokens in Enhancing Market sentiment

Governance Tokens Play a Crucial Role in Driving Market sentiment around Cardano (ADA) in Several Ways:

- Increased adoption : by Offering Rewards to Holders Who Participate in the Project, Governance Tokens Incentivize Adoption and Usage of Ada. This leads to increased visibility, social proof, and credibility within the community.

- Community engagement : GOSTNANCE TOKENS Enable the creation of a decentralized autonomous organization (DAO) which allows users to participate in decision-making processes. This Fosterers Engagement, Discussion, and Interaction Among Community Members, Driving Market Sentiment Positively.

- Revenue streams : Governance tokens can be used to create revenue streams through strike, voting, or other mechanisms that reward holders for their participation. This provides a financial incentive for investors and users to stay invested in the project.

- Tokenomics : The Tokenomics of Ada Governance tokens Allows for a more Dynamic and Adaptive Market. As New Contributors are added, the Token Supply Increases, Leading to Potential Price Appreciation on Time.

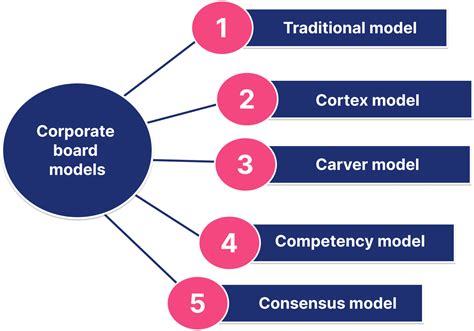

Ada’s Governance token Model

Cardano (ADA) HAS Implemented a Hybrid Governance Model That Combines Traditional token-based Governance with Delegated Autonomous Governance (DAY). This Model Enables Holders or Ada Tokens to Participate in Decision-making Promises Through Voting Mechanisms. The Dag Structure Provides An Additional Layer of Security and Decentralization, Ensuring the Long-Term Sustainability of the Project.

REAL-WORLD Examples

SEVERAL REAL-WORLD Examples demonstrate the Effectiveness of Governance tokens in Enhancing Market sentiment around cardano (ADA):

* Sushiswap : Sushiswap’s Native Token, Sushi, Has Been Instrumental in Driving Adoption and Visibility for the Project. The Token Provides Rewards to Holders Who Participate in Decentralized Liquuidity Pools.

Makerdao : Makerdao’s dai token has been used to create a decentralized autonomous organization (dao) that enables community-driven decision-making.

Conclusion

In Conclusion, governance tokens play a vital role in Enhancing Market sentiment around cardano (ADA). By Incentivizing Adoption, Community Engagement, Revenue Streams, And Providing A Dynamic and Adaptive Tokenomics Framework, Ada’s Governance Token Model has Proven to Be Effective. As the cryptocurrency space continues to evolve, understanding the power of governance tokens will Become Increasingly Important for Project Success.

Recommendations

If you’re interested in Learning More About Governance Tokens Or Cardano (ADA) Specifically, here are some Recommendations:

* read up on tokenomics

: Family yourself with the basics of tokenomics, including how it works and its’s benefits.